History and Evolution

1992

Anglo created a financial services division to incept the business of pension funds management for Anglo related companies.

1992

Saturnia Regna Pension Trust Fund was created as a pooled Fund offering composite services to the Anglo American Corporation Central Africa Limited (AACCA) Group. The pooled scheme also admitted pension funds for the first Defined Contribution Pension Schemes services namely:

- Hill and Delamain

- Total

- Chloride

- Deloitte and Touche

- Philips

The pension business was at the time supervised by the Ministry of Finance under the Fourth Schedule of the Income Tax Act.

1996

AACCA Management Services Limited (AMSL) was incorporated as a Manager for the pooled fund. It provided both pension scheme administration and fund management services to the Zambian market i.e. composite services licensed by the Pension and insurance Authority (PIA). The Pensions and Insurance Authority (PIA) was established as a body corporate following the amendments to the Pension Scheme Regulation Act No. 28 of 1996 as amended by Act No. 27 of 2005.

2000

Anglo sold 50% of AMSL to Botswana Insurance Fund Managers (BFIM) to concentrate its operations to the core mining business. AMSL rebranded to African Life Financial Services Zambia Limited (AfLife)

2004

Anglo fully exited from AfLife and BIFM increased its shareholding to 70%. Menel (a consortium of Zambians) acquired 30% of the AfLife business.

2008

AfLife commenced on a strategic process to bifurcate the composite services. Benefits Consulting Services Limited (Bencon) was incorporated to dedicate services into Pension Fund Administration.

2010

To comply with changes in law on shareholding of Fund Managers and Pension Administrators, Menel acquired an additional 21% in AfLife and Bencon to reach 51% equity diluting BIFM’s shareholding to 49%. Menel became majority shareholder as per requirement of regulation.

2012

PIA issued Benefits Consulting Services Limited (Bencon) with a separate license to administer pension funds in order to allow AfLife dedicate its management of pension assets under a separate license.

2013

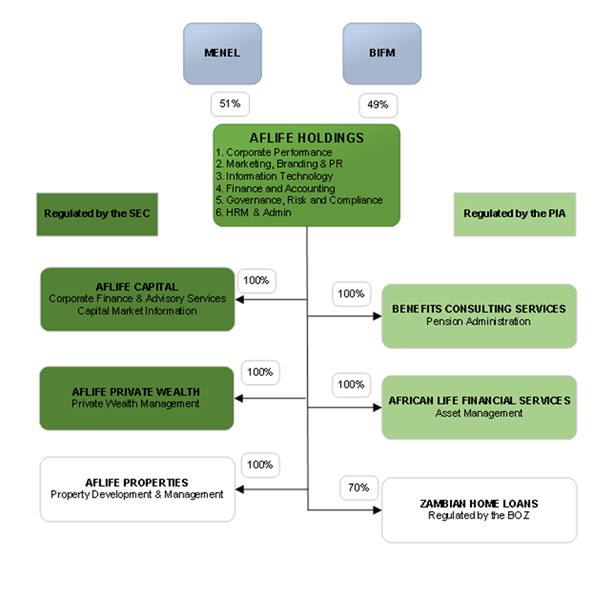

Bencon and AfLife continued operating independently under separate licenses as Associates maintaining common shareholding. Each entity owned by Menel (51%) and BFIM (49%).

2014

Quantum Assets Zambia Limited (now AfLife Holdings Limited) was incorporated to host all non-pension business and saw the creation of two wholly owned subsidiaries namely:

AfLife Properties (Z) Limited – Property Management and Development

AfLife Capital (Z) Limited – Corporate Advisory Services

2022

Equity re- organisation and implementation of the AfHold Group structure as follows: